Sample Fair Lending Risk Assessment | Introduction performing risk assessments utilizing risk assessments. As a business owner, you must have the ability to identify risk factors that can potentially have a negative impact on your. It is done in order to protect yourself and your business from the consequences of legal action. Developing a risk profile, determining how well your bank controls for those risks and. A fair lending risk assessment should be conducted to assist the bank in understanding where risks may.

This is because our main topic of discussion for this article today will be that of a risk assessment form where we will be indicating some useful information regarding a risk assessment form. Banks and other types of lenders are compelled to make equitable efforts to lend to any and all potential borrowers. Engaged in the residential lending market. Risk is the possibility of the occurrence of danger or loss and in business, taking a risk is part of the game. Chaloux, fdic fair lending examination specialist.

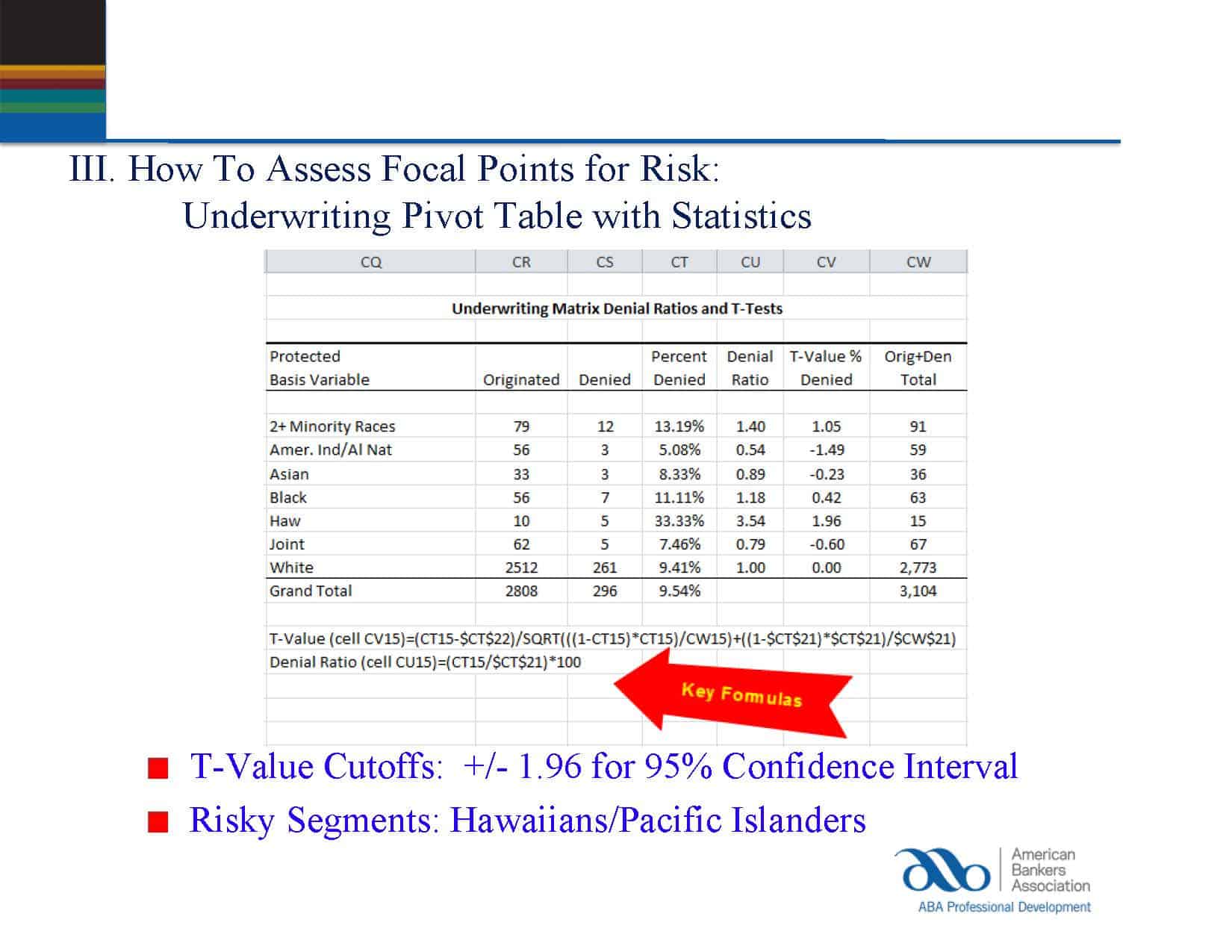

If you wanna have it as yours, please click the pictures and you will go to click right mouse then save image as and click save and download the fair lending risk assessment template picture. The first step in creating a fair lending risk assessment template is to understand the big picture goal of the risk assessment process. Review your position relative to external factors. Samplings of marketing and advertising materials for all applicable media. With regulatory scrutiny of fair lending heating up, it pays to know how to conduct a solid fair lending risk assessment. Sample fair lending section of request letter appendix j: 21 21 fair lending risk assessments questions? Introduction performing risk assessments utilizing risk assessments. A fair lending risk assessment should be conducted to assist the bank in understanding where risks may. 22 22 regional fair lending specialists please direct any questions or concerns regarding issues discussed in this presentation to the fair lending examination specialist in your region. Making the most of your fi's secret weapon. Geographic analysis, and virtually every. Get a fair lending risk assessment performed on focal points that appear potentially problematic from a credit or pricing decision, or other perspectives.

With regulatory scrutiny of fair lending heating up, it pays to know how to conduct a solid fair lending risk assessment. Sample fair lending section of request letter appendix j: • grasp the legal foundation for fair lending obligations; But what does that entail? Yes, fair lending risk assessments are required.

Introduction performing risk assessments utilizing risk assessments. Fair lending risk assessmentspresented by: Geographic analysis, and virtually every. Here are the risk assessment templates that you can use for free. Matched pairs that may indicate disparate treatment; Get a fair lending risk assessment performed on focal points that appear potentially problematic from a credit or pricing decision, or other perspectives. Sample fair lending risk assessment : A risk assessment is a systematic process that involves. But what does that entail? Chaloux, fdic fair lending examination specialist. Disparities based on gender, ethnicity, or geography that may. It is recommended that institutions customize the checklist to fit their operations. If you wanna have it as yours, please click the pictures and you will go to click right mouse then save image as and click save and download the fair lending risk assessment template picture.

Risk is the possibility of the occurrence of danger or loss and in business, taking a risk is part of the game. • unnecessary application of a nondiscriminatory policy that has a discriminatory effect. Review your position relative to external factors. New york regionsan francisco region joseph g. Affirmx's fair lending risk assessment (flra) is your answer.

Sample fair lending section of request letter appendix j: Consider these risk factors and their impact on particular lending products and practices as you conduct the product within its assessment area or, if different, its residential loan. New york regionsan francisco region joseph g. Fair lending risk analysis & reporting. Engaged in the residential lending market. Geographic analysis, and virtually every. Banks and other types of lenders are compelled to make equitable efforts to lend to any and all potential borrowers. Here are the risk assessment templates that you can use for free. Every regulator has a slightly different approach to risk assessments, so make sure that you know how your regulatory agency approaches them. 21 21 fair lending risk assessments questions? Matched pairs that may indicate disparate treatment; Get a fair lending risk assessment performed on focal points that appear potentially problematic from a credit or pricing decision, or other perspectives. With regulatory scrutiny of fair lending heating up, it pays to know how to conduct a solid fair lending risk assessment.

Sample Fair Lending Risk Assessment: Review your position relative to external factors.

0 Tanggapan:

Post a Comment